I have been updating our fund table recently, there are just too many funds these days. Amidst this overwhelming variety, I stumbled upon an interesting finding: all open-ended funds have no anticipated return. This discovery led me to delve deeper into the fundamental differences between open-ended and closed-ended funds. So, what exactly are these types of funds, and how do they compare?

What is Open-Ended Fund?

An open-ended fund is a type of investment where you can buy and sell shares at any time. Think of it like a store that never runs out of stock. You can go in and buy as much as you want or sell whenever you want. The price of each share is determined by the value of all the investments the fund holds, which is called the Net Asset Value (NAV). These funds are flexible and grow or shrink based on how many people are buying or selling shares.

These funds don’t have a fixed term, and can theoretically run indefinitely, until they decide to liquidate and close the fund.

The profit and loss of this type of funds are similar to stock, and can go ups and downs.

What is Closed-Ended Fund?

A closed-ended fund in this context is a bit different. Closed-ended funds has a definite term/ life cycle that is pre-determined. It sells fund shares during a one-time subscription period, similar to how a company might sell stock during an initial public offering (IPO), only the subscription period we are talking about can last for 2 years or so. After this initial period, the fund will be closed and will not entertained any new subscriptions. The next phase is the investment period (sometimes investment would start earlier, during the subscription period if they find good investment and have already fundraised the necessary fund). And then at the end is the divestment period.

There is no public second hand market or trading platform where you can buy or sell shares. Usually, investors hold their shares until the end of the fund’s life. Sometimes, the fund adviser or general partner will buy the shares from investor.

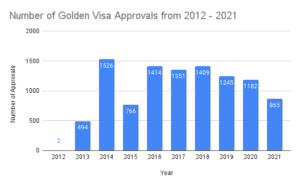

Most Golden Visa funds has a life term of 7-10 years.

Depending on the fund structure or the investment types of the fund, the fund may or may not have dividend paid during the holding period. And most of the funds will realize their biggest return towards the end of the fund, when the fund divest and sell of the investments.

The price/ value of the shares in this type of closed-ended fund is not determined by trading market. Instead, the value of the fund is assessed periodically, around every six months, based on the value of its assets, income, etc., just as you would if you want to evaluate a business, or a property. This reassessment determines the fund’s NAV, which is used to value the shares.

We have an array of close and open-ended funds eligible for the Golden Visa.

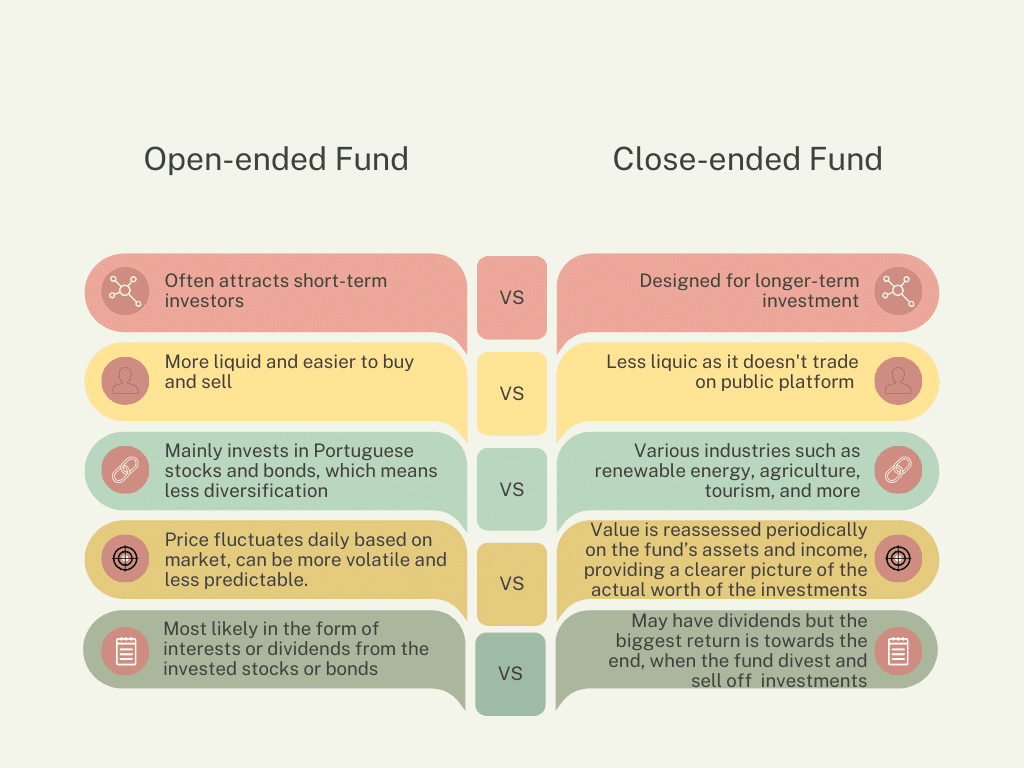

What Are the Main Differences Between Open-ended Fund and Closed-ended Fund?

1. Buying and Selling:

- Open-Ended Fund: You can buy and sell shares at any time.

- Closed-Ended Fund: After the initial subscription period, shares are not publicly traded. Normally, fund investor would hold until the end. Sometimes the fund adviser or general partner might buy them. We have several funds where the general partner/ fund adviser will sign an agreement with investors where investors could exercise a put option to sell the fund to the general partner/ fund adviser at a pre-determined set period. Contact us to know more.

2. Number of Shares:

- Open-Ended Fund: The number of shares can change as people buy and sell.

- Closed-Ended Fund: The number of shares is fixed and doesn’t change after the initial subscription period.

3. Pricing:

- Open-Ended Fund: The share price is based on the NAV, which is the value of all the investments divided by the number of shares.

- Closed-Ended Fund: The share price is based on the NAV determined by periodic reassessments of the fund’s assets and income, not by supply and demand on any trading market.

4. Historical Data:

- Open-Ended Fund: Open-ended funds typically have an established track record. This historical performance data is often highlighted in their brochures to give potential investors an idea of past returns. Despite having a track record, open-ended funds always include a disclaimer that past performance does not guarantee future results. This is due to the unpredictable nature of the financial markets.

- Closed-Ended Fund: Many closed-ended funds, especially newly established ones, do not have a track record. However, some funds may be in their second or subsequent series and could provide performance data from previous iterations.

5. Predictability:

- Open-Ended Fund: Highly unpredictable due to reliance on volatile financial markets.

- Closed-Ended Fund: More predictable as returns are based on the operational performance of tangible assets and businesses. Managing a closed-ended fund is more akin to running a business. Fund managers can study and forecast the profitability of these assets, leading to more predictable returns.

6. Anticipated Return:

- Open-Ended Fund: Open-ended funds typically do not include an anticipated return in their brochures. This uncertainty arises because open-ended funds mostly invest in stocks and bonds market and are heavily influenced by the stock market, bond market, and financial market/ economy in general. The value of the fund fluctuates in line with market movements, which can be unpredictable.

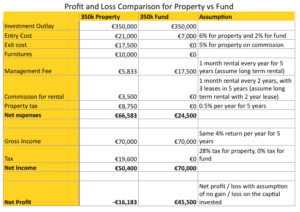

- Closed-Ended Fund: Unlike the speculative nature of stock prices, closed-ended funds can mostly likely provide an expected return reflecting a forecast based on the controlled performance of its businesses and assets can be forecasted and calculated based on their operational performance. . This forecast is more feasible because these funds invest in specific, predictable assets like renewable energy, agriculture, and tourism.

7. Nature of Returns:

- Open-Ended Fund: most likely in the form of interests or dividend from the invested stocks or bonds

- Closed-Ended Fund: Depending on the fund structure or the investment types of the fund, the fund may have dividend as well. But most of the funds will realize their biggest return is towards the end of the fund, when the fund divest and sell off investments.

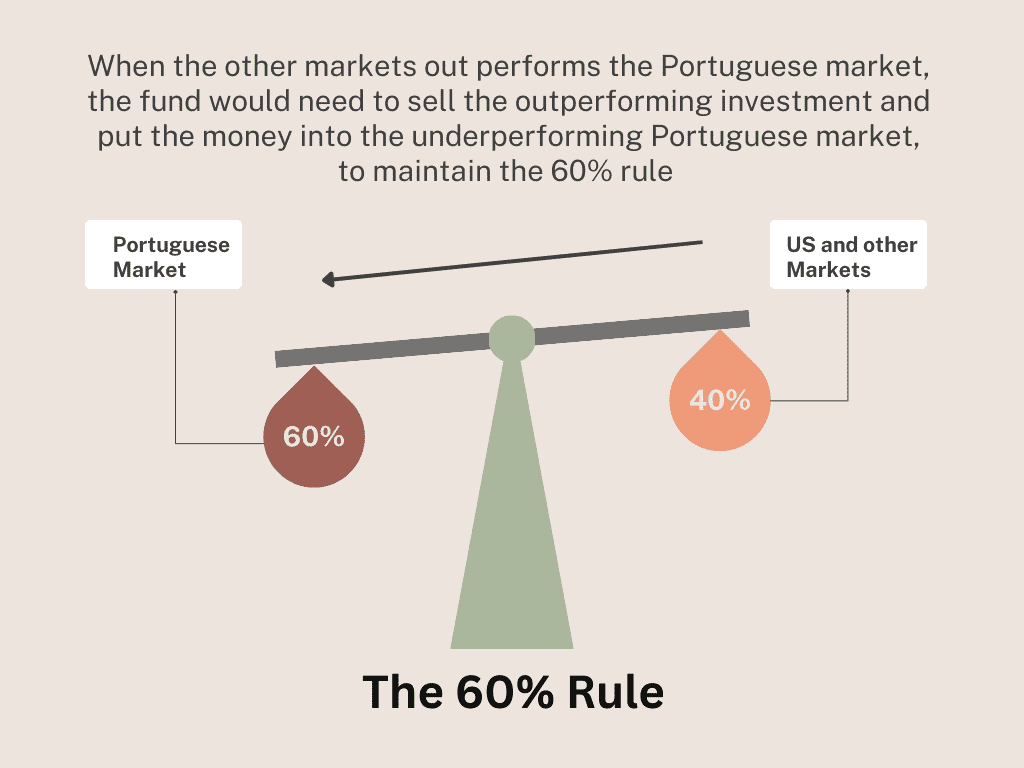

Portugal Golden Visa eligible funds need to invest at least 60% in Portuguese stocks and bonds – Why this rule place Open-End Fund at a Disadvantage?

Some, may say that but the open-ended fund can invest up to 40% in other markets too, so it is not exactly just investing in Portuguese stock and bond markets.

However, because of the 60% rule mentioned here. The open-ended fund may have to operate at a disadvantage, in some scenarios.

Imagine that an open-ended fund that invest 65% in Portuguese market and 35% in other markets. Whenever the other markets outperforms the Portuguese market (For example, the value of US stock market increased by 10% while the Portuguese market value fell by 5%). The fund would need to sell the investments in the US stock market and reallocate the money to the Portuguese market, in order to maintain the 60% rule.

In this case, the fund would have to sell outperform investments and invest in underperform investments.

6 Reasons Why a Closed-Ended Fund Might Be a Better Choice

1. Diverse Investment Options:

- Open-Ended Fund: Mainly invests in Portuguese stocks and bonds, which means less diversification. The Portuguese stock market has been highly volatile, and the PSI 20 (the Portugal stock index) has less than 20 companies, of which only a handful are truly large corporations.

- Closed-Ended Fund: These funds invest in various industries such as renewable energy, agriculture, tourism, and more. This diversification can reduce risk because your money is spread across different sectors, not just one.

2. Stability of Investments:

- Open-Ended Fund: The need to buy and sell shares frequently based on investor demand can force the fund to sell assets at unfavourable times, which might affect returns.

- Closed-Ended Fund: Since investors usually hold their shares until the end, there’s less pressure to sell assets quickly. This can lead to more stable and potentially higher long-term returns.

3. Valuation and Predictability:

- Open-Ended Fund: The price fluctuates daily based on stock and bond market movements, which can be more volatile and less predictable.

- Closed-Ended Fund: The value is reassessed periodically based on the fund’s assets and income, providing a clearer picture of the actual worth of the investments. This periodic reassessment can lead to more predictable returns.

4. Potential for Higher Returns:

- Open-Ended Fund: Limited to the performance of Portuguese stocks and bonds, which may not have as high growth potential as some emerging industry. The PSI 20 index has shrunk in size and only includes a couple of large companies like Galp and EDP, limiting the potential for high returns.

- Closed-Ended Fund: Investing in specific industries like renewable energy, agriculture, and tourism can offer higher growth potential, especially if these sectors perform well. Notably, tourism is a major driver of the Portuguese economy, and renewables are a growing trend in Portugal and Europe.

5. Less Market Volatility:

- Open-Ended Fund: Publicly traded, hence more susceptible to market swings and investor panic, which can lead to frequent changes in value.

- Closed-Ended Fund: Not being traded on the public market means it’s less affected by daily market volatility and investor sentiment, which can lead to more stable investment performance.

6. Mid / Long-Term Focus:

- Open-Ended Fund: More liquid and often attracts short-term investors, which can lead to higher volatility and short-term focus.

- Closed-Ended Fund: Designed for longer-term investment, encouraging investors to hold their shares and focus on long-term growth rather than short-term gains.

Conclusion

In summary, a closed-ended fund can be a better choice because it offers more diversification across various industries, stability through less frequent trading, predictable valuations, potential for higher returns from emerging sectors like renewable energy or dominate sector like tourism, reduced market volatility, and a long-term investment focus. These factors can make it a less risky and more attractive option for investors looking to invest in the 6-8 years time frame or longer.

The Portuguese stock index PSI, are not particularly the same as some larger and stronger stock indices like S&P 500, FTSE100, where you are more confident that the companies in the indices would have rather strong longer term growth prospect, regardless of the short term volatility.

However, to each of their own, some investors with higher risk appetite may still opt to invest in open-ended funds as part of their entire Golden Visa investment portfolio. The obvious advantage is that they are easier to buy and sell. However, the average golden visa investor is not in it for the buy and sell. A typical Golden Visa investors would hold their investment for an 6 – 8 timeframe on average, and very rarely would they sell the investment during this time frame.

P.S. Tax

Additionally, if you are interested in open-ended fund, it is advisable to ask the fund manager the tax treatment of the fund. Because, unlike the 0% tax and 10% tax for non-tax resident and tax resident respectively. The tax treatment of some open-ended fund doesn’t enjoy as favorable a term when it comes to income tax!