Please note that this statistic is the final approval of Golden Visa (after your biometrics), and so you are probably seeing the trend for 1st to 3rd quarters of 2021 applications.

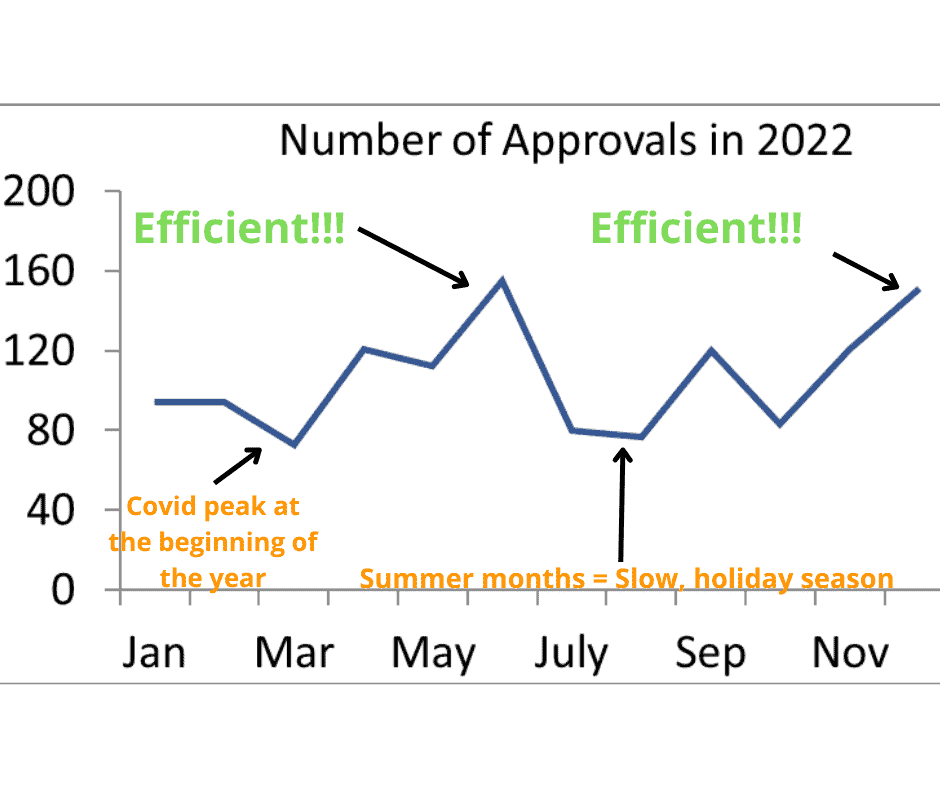

Golden Visa Approval by Month

We have charted the SEF approvals of Golden Visa by month below.

We can see that the number of approvals by months fluctuates a great deal, with summer months being slower than any other periods, and the peak of the Covid at the beginning of 2022 also plummeted the number of approvals. But all in all, in 2022, we have a total of 1281 approval, that is 415 cases (48%) more than 2021!

2022 Golden Visa Trend

Top Nationality for Portugal Golden Visa

From January – December 2022, the top nationalities of Golden Visa investors are

- United States – 216

- China – 213

- Brazil – 109

- India – 83

- South Africa– 79

US citizens have surpass Chinese to the number one position of Golden Visa investors. We shall be seeing this trend continues well into 2023, with even a much stronger prominence of US citizens. Other countries after the top five are UK and Turkey.

2022 Total investment on Portugal Golden Visa amounted to 654 292 327,91 €

The top investment routes for Portugal Golden Visa 2022 are:

- Property – 1008 applications (79%), of those invested in property,

- 52% applied for the 500K & 400K category

- 48% applied for the 350K & 280K category

- Fund – 236 applications, (18.4%)

- Capital transfer – 31 applications, (2.4%)

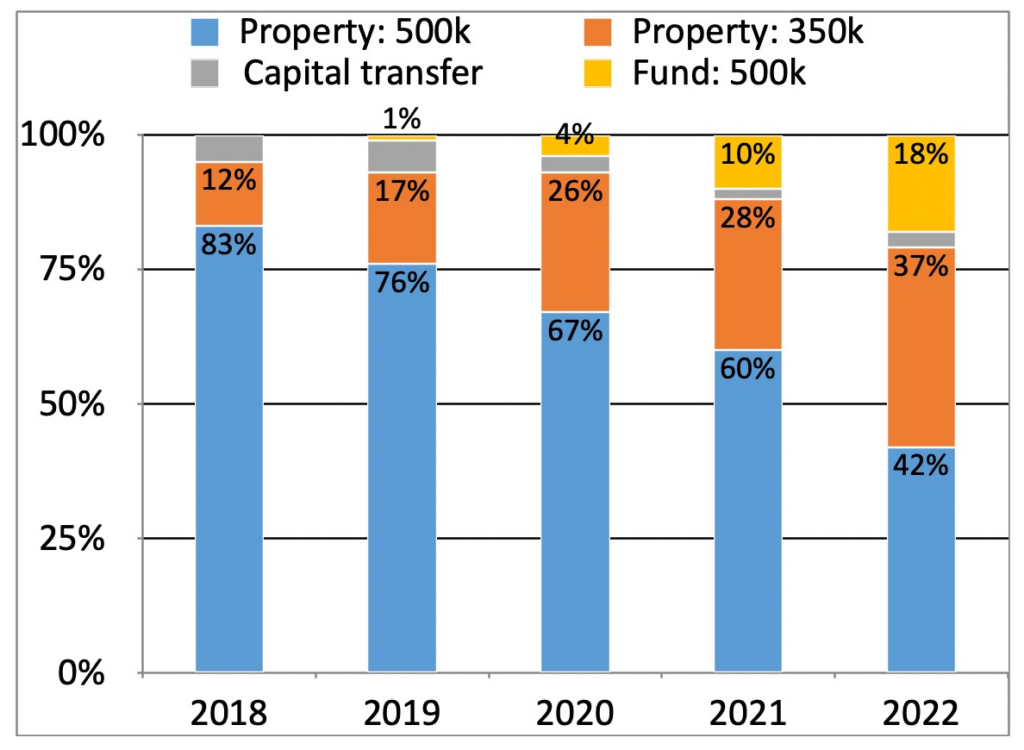

Investment Options Trending Over the Years

We have done a trend analysis for the investment routes on property and fund from 2018 (where fund investment was introduced) to 2022, and we can see the evolvements of the different investment routes.

We can see that the Fund route has increased from 1% in 2019 to 18% in 2022, while property has decreased from 95% to 79%.

An interesting finding is that the 500K property options has decreased drastically by half while the 350K options has more than triple. This maybe due to the popularity of the program gained not only by the high net worth individuals, but more and more by the middle class.

The Golden Portugal 2022 Client Statistics

Here goes our second infographics on The Golden Portugal’s clientele of 2022. (Here is our 2021 statistics, if you would like to take a look).

Some key findings:

Investment routes

Just the opposite from last year. This year, the majority of our clients went thru the property routes. The major reason is the increase of investment threshold from 350K to 500K. Meaning it is almost double the amount when comparing to the lowest entry point for property (280K).

Client profile

We have grouped our clients by regions, instead of by each single country. This way, we can see different trends. For example, we can see that Middle East + Turkey investors make up a good portion of GV applicants. We don’t see this in the SEF statistics as there are many smaller countries in Middle East, and we won’t be able to see this trend if we group by country.The majority of clients are the same as the general trend – China and USStill, the ‘rest of the world’, constitute 1/5 of our clients. We have expanded our footprint in many countries this year, especially in the Middle East region. We are happy to announce that this year we have added 9 new countries that we serve – Canada, Nigeria, Syria, Lebanon, Jordan, Iran, Isreal, Thailand and Azerbaijan.

Property Investment – amount and type

Let’s take a closer look at property investment:

A whopping 64% of investors chose the rehabilitation route with the lower 280K and 350K investment. It shows that a lot of clients are taking advantages on the low investment threshold of the program, especially when compared to other Golden Visa programs in Europe.

1/5 still opt for 500K above investments.

Over half (56%) invested in the low density area – because of the lower investment threshold and also the ability to buy a pure residential property in those area.

- A break down of property types:

- 36% opted for hotel buy back (the hassle free option)

- 36% opted for pure residential in non restricted, mostly low density area

- 28% opted for hotel free-hold units with no buy back (the lifestyle option as these are likely the more luxury hotel where investors can stay in the hotel for several months a year), or serviced apartment in restricted areas like Lisbon.