Portugal Golden Visa investment options —- Real estate? Funds? Fully managed properties? Guaranteed income? Buy back option? How to choose from all these?

The minimum investment thresholds for the various Portugal Golden Visa investment options are different. This means your budget may already have filtered out some of them.

Check out here for a full list of the Portugal Golden Visa investment options and it’s minimum investment threshold.

In this article we will first take a look at the Portugal Golden Visa investment options statistics, and see which ones are most popular. And then we will categorise applicants into several different categories and see which investment options may be most suitable for them.

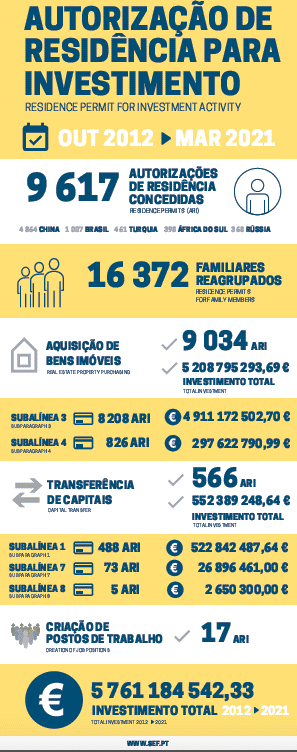

Portugal Golden Visa Statistics on Investment: From 2012 – 2021

This is the statistics of the Portugal Golden Visa program from 2012 where it was first launched until Q1 of 2021.

- Number of main investor application: 9617

- Number of dependent application: 16372

- 94% of applications chose property investment; 5% chose capital transfer of 1 million or more; while only less than 1% went with funds

See the breakdown of Portugal Golden Visa investment options below:

| Investment options | No of applications |

| 500k property purchase | 8208 |

| 350k property purchase | 826 |

| Capital transfer | 488 |

| Investment in funds | 73 |

| Investment in company | 5 |

| Creation of jobs | 17 |

So why is there an overwhelming majority of applicants choosing property investment over the other options. There are a few reason:

Capital Transfer of 1 Million

There aren’t that many people who have the cash or the willingness to go for the 1 million capital transfer.

Creation of Jobs

Creation of jobs sounds like a reasonable route for people who is planning to start a business in Portugal. However, the commitment of maintaining 10 jobs throughout the 5 years period may be seen as a risk factor if the business doesn’t do well. In addition, for those who intent to start a business and live in Portugal, buying a property is seemed as a necessity, a first step and a less risky choice for many.

Investing in Company

Investing in company is a more specialized activity and option. It also has an employment requirement which is a risk factor. Sourcing a trustful and profit making company to invest in is not an easy task and investing a large sum of money into the hands of others is another risk factor.

Investing in R&D and Arts & Heritage

Other options such as investments in R&D and arts and heritage is quite vague and too specialized. There is a lack of both market demand and market supply. Thus there is a ‘zero’ figure on these options.

Investment Funds

Investment in funds is gaining popularity now. But why is it that it only makes up less than 1% of the investment options chosen?

First of all, the investment funds option only started in 2017, around 3 years ago. And when it first started, there aren’t many funds offered on the market.

Second, when you see the nationalities who applied for Portugal Golden Visa, the majority proportion was/is Chinese. And real estate is the go to asset for Chinese. It is a tangible asset that is owned outright and seen as a value holding asset.

Third, we are seeing more and more applicants choosing funds, but there is a time lag of the showing up in the statistics, as it only shows applications that have been approved, which could take several months to one year with the current Covid situation and many can’t come to get their biometric done.

We are seeing that the number of funds that are targeting to Golden Visa applicants have tripled during the last year. There are a couple reasons for this:

- The investment fund options only really started to gain popularity in the recent one year or so. This also coincides with the increasing popularity of Portugal Golden Visa amongst Americans, since they are more open to and familiar with funds.

- The anticipated termination of property investment for Portugal Golden Visa, which was first discussed in early 2020.

With the biggest investment option (real estate investment) partially shutting down, it would give rooms for other options to grow and prosper. In fact, it is the intention of the policy change – to shift the foreign direct investment (FDI) elsewhere, not just focusing on residential properties in big cities like Lisbon, Porto, Algarve. And in the case of Lisbon and Porto, to steer the focus on commercial property like offices and shops.

We shall see how the whole situation and the percentage share of the investment routes will evolve with the changes of Portugal Golden Visa regulations taking place in 2022.

Pick the Portugal Golden Visa Investment Options According to Your Goals

For the aforementioned reasons, we will just be focusing on real estate and funds.

To begin with, we will categorise Golden Visa applicants into 3 main categories.

We will then investigate which type of real estate/ funds options is suitable for each category, breaking down the options according to characteristics such as buy back, income guaranteed, capital guaranteed — and give some insight on the decision points you should be looking into.

We hope this post would help you to rethink in another way, not in terms of funds or properties, but in relations to your final objectives and goals.

Below is the most common categories investors fall into, and it will largely determine what type of Portugal Golden Visa investment options would make more sense and appeal to you.

Let’s begin with the obvious.

Type 1 – You are planning to move and live in Portugal in the near future

This one has an obvious answer. If you are planning to live in Portugal in the near future (say, in the coming one to two years), buying a property for self use may be one of your top choice.

Owning your own home gives you better quality of life in a new country. You have the flexibility to remodel or decorate it however you like, save you from paying rent, and gives you a sense of settling down in a foreign country. Staying in the same home let you get familiar with the public transportation system, the neighbourhood, the junta de freguesia (parish council), the market, the cafe, the butcher and so on. You and your children would be able to make friends in the neighbourhood or in school.

If this is you, you could be looking for your own property, either a new development or a property in the second hand market.

Some questions you might be asking are:

- is this a safe neighbourhood?

- your lifestyle – do you want to live in the country side or in the buzzing centre of the city?

- Is it close to school, supermarket, park, daily necessity/ facilities?

- Will you be taking public transportation, and if so, is it close by?

- …………

How to choose the right neighbourhood could be another separate post. In this post, we would stick to the different Portugal Golden Visa investment options.

Type 2 – You just want to take the lowest risk, preserve your capital, and take the money out as quick as possible

Then there are those who just want to get the residency or citizenship/ passport, with minimal risk and minimal cost. You want to preserve your capital and ideally take the money out as soon as possible.

The main reasons behind for this group of investors:

1. You see the investment as a mean to get the visa and eventually the citizenship or permanent residency, and not necessarily an investment to get a high potential return. You want to just park the money in a safe place, with a low cost, low maintenance option. OR

2. You are not familiar with Portugal and are not too sure about the investment environment of Portugal. OR

3. You intended to invest in property, however with the pandemic, you are not able to come and do property viewing and prefer to find a low risk and low cost option as an alternative (to catch the deadline before the regulations change).

The typical requirements for Portugal Golden Visa investment options are

- Low risk – the main goal is to preserve the capital

- Low cost

- Low maintenance

- Able to exit the investment in a timely manner (around 6 years where they then get the citizenship and permanent residency)

- Preferably with a reasonable return

There are a couple options for this type of clients: - Capital perserved fund - Property / Hotel projects that have buy back options

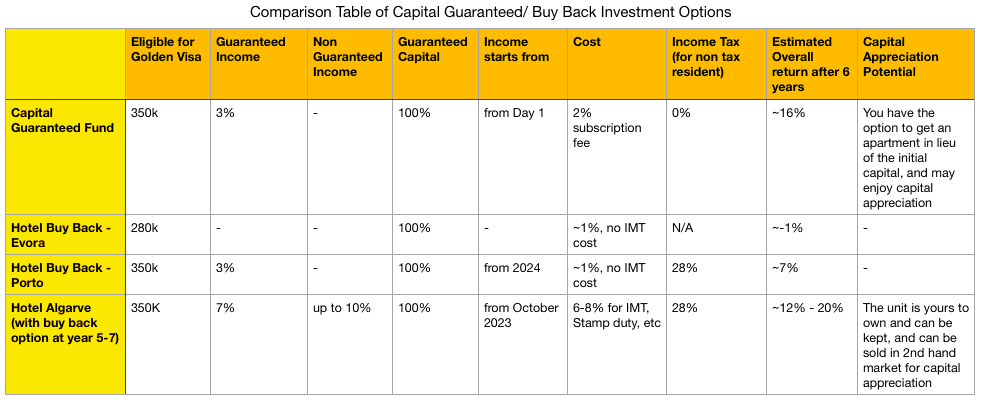

Below is a table of all capital guaranteed/ buy back options at The Golden Portugal with detailed information on cost, income and investment outlay.

Some decision point when choosing this type of options:

The amount of capital outlay

Since the objective is to preserve your capital, so, the lower the outlay the better. Mostly this type of investments are for 280k or 350k Golden Visa.

Any guaranteed income?

Most of the time this type of projects also gives a modest guaranteed income, around 3%. There are also buy back projects that generates 7%-10% income. To the other extreme, there are also some that gives out zero return.

When does it start to generate income?

Other than yearly return rate, you should also consider the timing of when the project starts generating income, as your investment timeline is typically around 6 years. A project that generates a higher return 3 years into the investment may not be as attractive as other options that starts generating income earlier but at a lower rate.

In the case of most hotel buy back projects, they are only in the initial phase of construction, and you will need to wait a couple years before it starts to operate and generate income. The capital guaranteed investment funds has the advantage on this point in that it starts generating income from day 1 of subscription.

When can I get the money back?

All the above options have the investment timeline that matches a golden visa (ie. investor can exit the investment at around year 6 – 7, when they get their citizenship and permanent residence).

What are the related cost?

Normally fund is more cost efficient than property. Typically, there is no cost related to fund other than the fund subscription fee. For property, it normally involves IMT, stamp duty and notary fee, which can add up to ~7.5% of the property price.

For all of the options, the guaranteed income, if applicable, is already net of all maintenance/ management cost. That is, you do not have to pay other expenses during the whole term of holding the asset.

What are the income tax for each options?

Rental income and capital gain for property is taxed at 28%, while income tax for fund dividends or capital gains from funds are tax exempted (0%) for non tax residents.

Take a look at Portugal Golden Visa Funds versus Property: A Complete Cost Comparison.

Talk a look at the various capital guaranteed / buy back funds.

If you want a detailed cost analysis of each option, please contact us.

Type 3 – You want to build a portfolio of assets, and expand your investment in Portugal

You want to build a portfolio of asset and to hold mid – long term, for cash flow and/ or capital appreciation.

There are many reasons why you may want to invest in the real estate or fund markets in Portugal. You may be in the process of diverting your portfolio from stock to property or vice versa; or from a certain currency (eg. US$ assets, GBP assets) to Euro assets; or you may want to balance your portfolio with more or less risky assets; or you want to diversify your assets geographically.

You want to make good use of your money and invest and at the same time get the Portuguese residency with the Golden Visa.

If this is your main goal, then there are many more decision points you should ask yourself:

How long do you want to hold these asset? Mid term? Long term? Maybe even to pass it on to your children?

Funds have a limited, and somewhat a fix holding period, you would want to see this on a case by case basis and see if the holding period matches your investment timeline. With a property (no buy back option) you will have much more autonomy on the holding period.

One of the many advantages of holding a Portuguese asset is that the inheritance tax is 0% to spouse and direct descendent/ ascendent. Meaning that you can pass on your property to your kids without paying any tax! (note: you may still have to pay tax in your residence/ home country according to its laws).

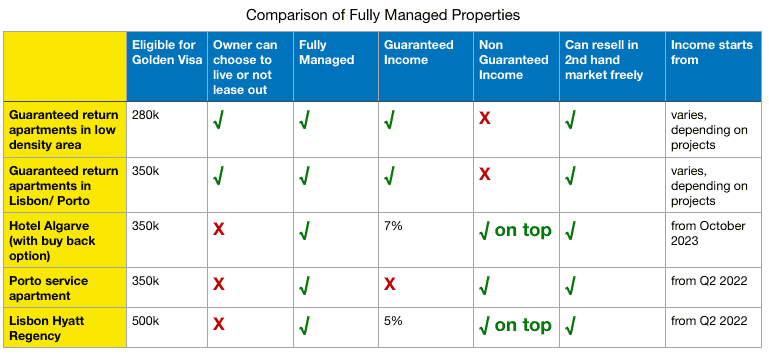

How involved do you want to be on managing the asset?

Funds are managed by fund managers and are totally passive assets. Properties could be passive or active. You have a whole spectrum of involvement in property — you can

- managing the property yourself; or

- hire a property management company to handle it for you; or

- buy a property that is fully managed by the developer or a hotel chain

If you are interested in fully managed properties, here is a comparison of different options.

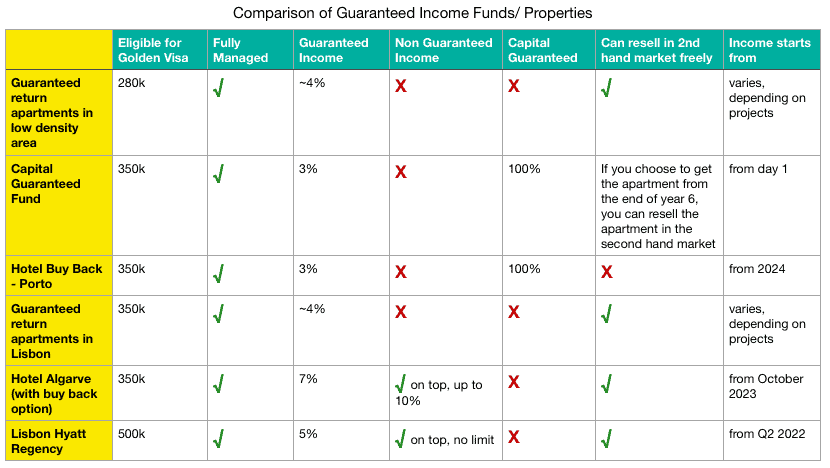

Do you want to ensure a steady income/ cash flow?

If you want your investment to generate cash flow, there are income guaranteed options in the market which gives you peace of mind. You will be sure your asset is generating income and won’t become a liability (no income but expenses like management fees, maintenance fees, etc) in testing times

Income guaranteed funds

Do you want something tangible and something you can enjoy?

Property is a tangible asset, while fund is not. If you buy a property, you will be able to use it for some period of time. One of the perks of hotel projects is that it has owner’s usage right, where owner can use the hotel for several nights per year, to enjoy a nice vacation.

What is your risk profile?

If you have a higher risk tolerance and appetite and are looking for a higher return, then the guaranteed income may not appeal to you. But there are funds that have a higher expected return (eg. ~15%), for those who is more risk tolerant.

Also you may not have your capital guaranteed when buying a property or hotel unit without the obligatory buy back, but you would get the upside for any capital appreciation.

Do you want to diversify your investment?

Fund is a better alternative to diversity your investment. instead of owning one or two units, funds invest in different companies that hold different assets, from real estate developments and rental properties, to other businesses in a variety of industries. You can choose funds that invest in a specific industry such as growth companies, medical science and so on.

What else?

Don’t forget to take other decision points into considerations, like the cost and tax, as discussed above for the Type 2 categories.

How to pick the Portugal Golden Visa investment options best suited to me?

These are a lot of information to digest, and a lot of options to choose from. The Golden Portugal specialises in finding the appropriate Portugal Golden Visa investment options/ projects according to your need and providing detailed analysis on the different investment options for you to make an informed decision.

If you want to discuss about the different Portugal Golden Visa investment options/ projects and get a detailed cost analysis on your preferred options, please contact us.