Portugal Golden Visa Program 2025 – A Complete Guide for Residency & Citizenship

New Citizenship Law

Great news on Portugal Golden Visa.

The new law has been published. For Golden Visa applicants, the 5 years clock for applying citizenship will start ticking from the moment you submit your online application.

Portugal Golden Visa Webinar

Big Updates You Can’t Ignore

What is Portugal Golden Visa Program ?

The Portugal Golden Visa Program is a residency permit program designed for non-EU citizens. By engaging in specified investment activities (ARI) , applicants can obtain Portugal permanent residence and eventually have the opportunity to acquire Portuguese citizenship. For those investors aspiring to immigrate to Portugal, the Golden Visa stands as a gateway to the life of Europe. Compared to other countries, Portugal has the lowest residency requirements, no stringent stay mandates and offering tax- exempt status for fund investments, making the path to citizenship more straightforward and advantageous. This program is highly recommended for investors seeking greater flexibility while aiming to unlock the potential for residency and eventual portuguese citizenship within this vibrant country.

Portugal Golden Visa Program Requirement

Qualifying Investment:

- €500,000 in fund investment

Portugal Residency Requirements:

- No need to live in the country. Minimal stay for 14 days per 2 years

- Permanent residence: after 5 years of Portugal Golden Visa

- Citizenship: after 5 years of Portugal Investor Visa

Portugal Golden Visa Features

✓ Part of the EU and Schengen Area

✓ Residence Permit

✓ Right to work and start business

✓ Access to residency benefits such as public healthcare and education

✓ Dependents – spouse, children, and parents

Portugal Golden Visa Program Benefits

1. Visa-Free Travel

Enjoy visa-free travel within the Schengen Area, allowing for travel across 27 European countries. This offers greater ease and flexibility to explore Europe for business, leisure, or visiting friends and family.

2. Residency and Work Authorization

Unlike other countries, the Portuguese Golden Visa allows the applicant the right to live, work, and study in the country. This opens doors for career opportunities or educational goals.

3. Enjoy Residence Welfares

The Golden Visa Portugal provides applicants with free public healthcare and public education.

4. Higher Freedom of Movement

Compared to other residency programs, Portugal Golden Visa maintains a very minimal stay requirement, —staying in Portugal for just seven days in the first year and fourteen days in subsequent two-year periods.

5. Pathway to Citizenship and EU Passport

After 5 years of maintaining the Portuguese Golden Visa and adhering to stay requirements, Golden Visa investors can apply for permanent residency and, ultimately, Portuguese citizenship. This grants the benefits from Portugal Residence Permit, including the right to live, work, and study anywhere within the European Union, plus the benefits of a local residence such as public healthcare and public education in the residing EU countries.

6. Able to exit your investment after 5 years

Most Golden Visa are tied to your investment, meaning you will no longer be able to renew your residency if you sell your investment. But for Portugal Golden Visa, after 5 years, you can apply for citizenship and sell your investment freely.

7. High Quality of Life

The Portugal Gold Visa offers a high quality of life with pleasant climate, rich culture, and strong healthcare system. This can be a significant advantage for those seeking a comfortable and fulfilling lifestyle. Read here on why Portugal maybe the ideal country for your second passport.

8. Favorable Tax Environment

Portugal offers a Non-Habitual Resident (NHR) tax scheme that can deliver substantial tax advantages for up to ten years. Through the NHR program, foreign-sourced income, such as pensions, dividends, and royalties, may be exempt from taxation.

Portugal Golden Visa Overview 2025

Get in Touch with a Portugal Golden Visa Specialist

We offer a free complimentary consultation via video calls to address your unique needs and questions. To book your initial consultation, simply click here, or complete the form below.

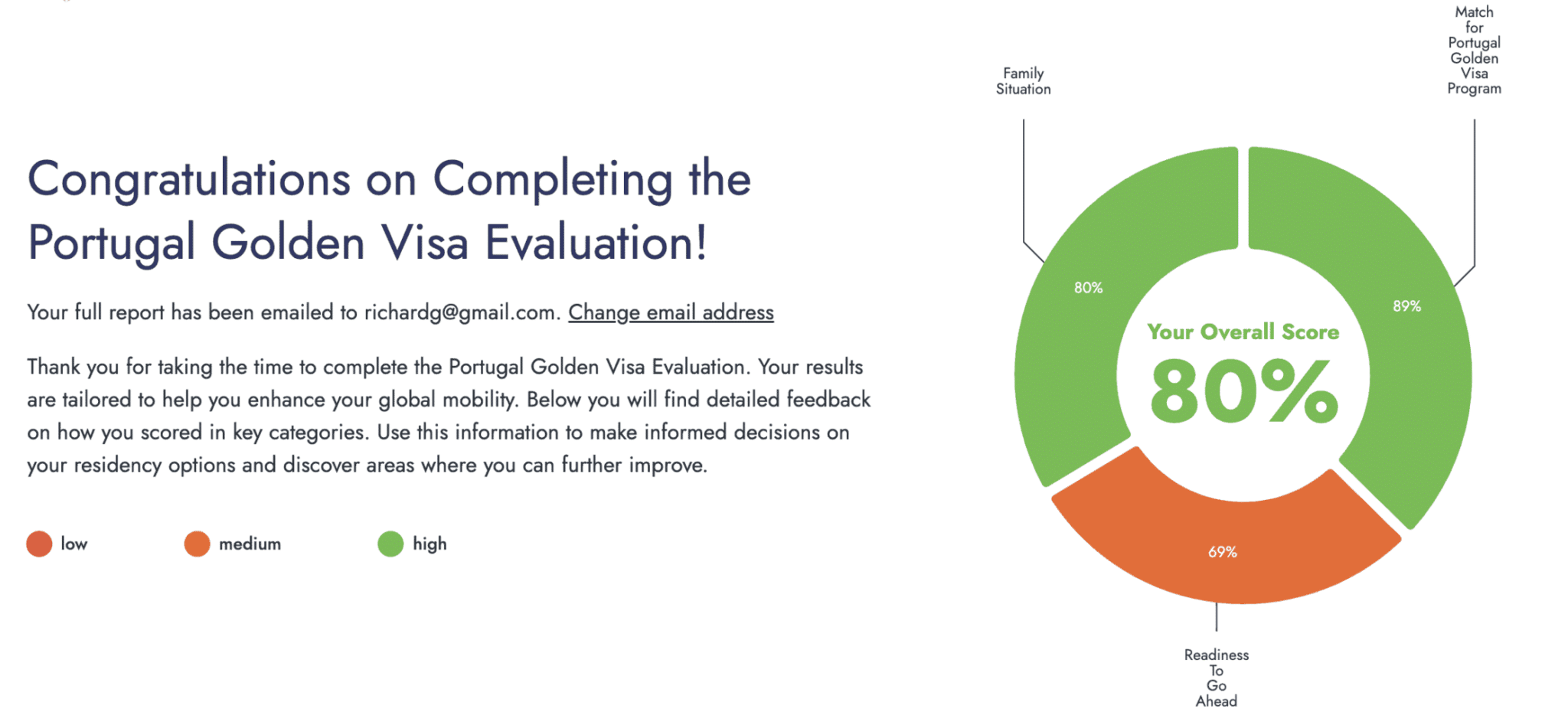

FREE QUIZ:

Is Portugal the Right Fit as Your Second Home/Second Passport Option?

Answer a few questions and instantly check which Visa option is most suitable for you.

Qualified Investments for Portugal Golden Visa in 2025

Termination of Real Estate Route

Note that real estate and 1.5 million capital transfer are no longer investment options for Portugal Golden Visa starting from October 7, 2023.

PORTUGAL GOLDEN VISA INVESTMENT FUND VIDEOS

Explore exclusive Golden Visa investment opportunities with our curated fund videos. Learn how to secure your Golden Visa through most poluar investment funds.

Portugal Golden Visa Application Procedures

After you have decided that Portugal’s Golden Visa is your ideal choice, you might want to get more information on the investment options, and to start preparing for the application. Below is an outline of the procedures for applying for the Golden Visa, step-by-step, to give you an idea of the process. We understand there are major decisions to be made here, and dealing in Portuguese may make things more complicated, trust us that The Golden Portugal team is here to help you along the way.

Average Time For Online Application Submission (Step 1 – 6) :

~3 Months

Step 1 – Initial Consultation

Begin with an initial consultation to assess your unique case and explore the investment options that align with your goals.

Step 2 – NIF & Bank Account

We will assist in obtaining a taxpayer ID number (NIF) for you and your family, and introduce you to a bank manager to facilitate account opening.

Step 3 – Investment Options

Based on your needs, we’ll identify and recommend suitable investment opportunities.

Step 4 – Transfer money and make the Investment

Transfer the necessary funds to your Portuguese bank account and proceed with your chosen investment. Specific procedures may vary depending on your investment option.

Step 5 – Gather Personal Documents

Gather all required documents for the SEF submission. We’ll provide guidance and collaborate with relevant parties, such as the bank manager and fund manager, to acquire the necessary documents.

Step 6 – Online Application Submission

Your lawyer will submit your application and accompanying documents online. Be prepared to pay the visa processing fee during this step. Your five-year Golden Visa residency period commences from the date of your payment.

Step 7 – Biometrics

We’ll receive a notification for your biometric appointment to provide biometric information, including fingerprints and photo. You’ll need to submit the original application documents during this appointment.

you’ll be required to pay the Golden Visa issuance fee to the government at the appointment by a debit card (no credit card or cash is accepted)

Step 8 – Approval and Residence Cards

Once your application is approved. We will collect your residence cards on your behalf and arrange for them to be sent to you.

Apply Remotely

Please note that all steps and processes, except for step 7 (Biometrics), can be conveniently completed remotely without the need for you to visit Portugal. Our dedicated team is here to ensure a smooth and hassle-free Golden Visa application experience. Feel free to contact us for an initial consultation to get started on your Golden Visa journey.

Documents Requirements for Portugal Golden Visa

Documents to be obtained in your country of origin

Documents to be obtained in Portugal (we will prepare for you)

FAQ on Portugal Golden Visa Program

Greece’s Golden Visa: Your Strategic Gateway to European Residency

In a world of shifting global dynamics, savvy investors are seeking more…

Discover Investment Opportunities in Portugal for Crypto Traders

Portugal’s Stance on Cryptocurrency Portugal is recognized as one of Europe’s most…

We Have Upgraded Our Lisbon HQ, and You Are Invited

We’re excited to share some great news: earlier this year, we moved…

2025 European Golden Visa Comparison: The Unrivaled Value of the Portugal Golden Visa

In an ever-evolving global landscape, high-net-worth individuals increasingly seek the stability and…

[June 2025] Golden Visa Update

We know how important this journey is to you and your family…

How Americans Are Using Their IRA or 401(k) to Invest in Portugal’s Golden Visa

In today’s volatile political climate, many Americans are thinking seriously about a…

Buying Property in Portugal: How to Buy, What to Know, and Tips for Foreigners

Portugal has become one of Europe’s hottest destinations for buying property, attracting…

Portugal’s Recent Election and What It Means for Your Golden Visa and D Visas Plan

The recent May 18 parliamentary elections in Portugal have confirmed a continuation of centre-right leadership,…

Event Recap: London Tour 2025 – Explore Your Future in Portugal!

We just got back from an incredible few days in London and…

EU Courts ruling against Malta’s Golden Passport program and what it means for Portugal Golden Visa

In fact, the recent court ruling concerned Malta’s program, which was shut…

Portugal’s Golden Visa Gains the Spotlight Amid Global Uncertainty in 2025

As of April 3, 2025, Spain has officially shut down its Golden…

The Ultimate Guide to Remote Working as a Digital Nomad in Portugal

Portugal has become a top destination for digital nomads, offering excellent infrastructure,…

Portugal Healthcare for Expats: How to Access & What You Need to Know

Portugal’s healthcare system is widely recognized for its quality and accessibility, making…

2025 Portugal vs. US Cost of Living Guide: Is Moving to Portugal a Better Deal?

As living expenses in the US continue to rise—driven by skyrocketing housing…