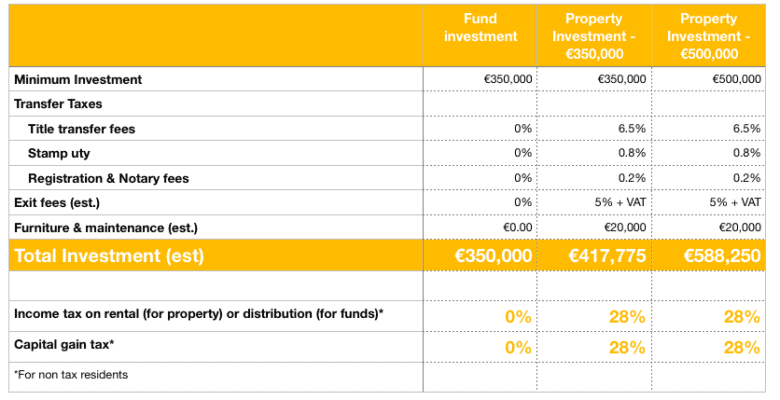

Although property investment is still by far the most popular route for Portugal Golden Visa application, the fund investments route is gaining steam at the moment as more and more funds are qualified for the Golden Visa scheme. Here we will give you a break down on the estimated cost comparison for these two investments.

For illustrative purposes, we have only include the two most popular options of property investment – the 350k option and the 500k option. For the low entry property investment (280k), the title transfer fees and stamp duty percentage would be lower.

1. Less cost with fund investments

Funds don’t have all the transfer fee of a property like stamp duty, title transfer and so on.

And if you want to rent out the apartment furnished, you would need to put in furnitures. Plus real estate commission to get your apartments rented out, building management fee, and property management fees. The difference on cost for funds and property investment at the same amount (350k euro) comes to a 65k euro differences..

2. Less tax with fund investments

NO income or capital gain tax on your fund investment if you are a non tax resident of Portugal.

With fund, you don’t need to pay any income or capital gain tax if you are a non tax resident of Portugal. You only need to registered as a Portugal tax resident if you reside in the country for more than 183 days.

With property, regardless you are a tax resident or not, you need to pay tax on the income annually and on the capital gain when you sell the property.

3. Less hassles with fund investments

Fund investments has a fund manager to help you invest and manage the fund (fund management fee varies). Property investments is a big hassle if you have to manage it yourself. But you can hire a property management company to handle that for you.

Is fund the better option for getting your Portugal Golden Visa?

No, it depends. Fund investments have lower cost and lower tax. That’s objectively true. However, the knowledge of choosing a good fund investment and a good property investment are two different skill sets. And the choice should rest on which options you feel more comfortable in investing and in choosing.

It would be wise to go thru a trusted partners for either investment options. Find a one-stop solution provider to ensure that they are not just there to sell their products, but get the property or fund vetted and are there to accompany you throughout your journey of getting the passport.

Also, for most property options (other than buy back ones), you can choose to hold it for as long as you wish and you can even pass it to your descendent, but fund usually has a limited holding period, after which the fund needs to exit and the profits are distributed to the investors.

Also, property investment may allows you to add value (through refurbishing, adding a bedroom, etc) to the property. Whereas in funds, you don’t have this type of autonomy or opportunities for value add to your investment.