In today’s volatile political climate, many Americans are thinking seriously about a “Plan B”—a secure alternative for themselves and their families should life in the U.S. become unsustainable. For those looking abroad, Portugal’s Golden Visa program checks all the right boxes:

- ✅ A long-term backup plan—without requiring immediate relocation

- ✅ A politically stable, safe, and welcoming country

- ✅ Affordable cost of living and high quality of life

- ✅ A Western lifestyle and culture that feels familiar

- ✅ Widespread English proficiency, making it easier to adapt

- ✅ A clear pathway to EU residency and future citizenship

But there’s one major hurdle: the €500,000 investment requirement.

Many Americans hesitate—not because they lack the will, but because they lack liquidity.

💡 What If You Didn’t Need to Pay Out of Pocket?

What if you could tap into your existing retirement savings—like a 401(k) or IRA—to fund your investment without affecting your daily cash flow?

Here’s how:

✅ By setting up a Self-Directed IRA (SDIRA) or Solo 401(k), you can legally and tax-efficiently invest in a Golden Visa-eligible private equity fund.

🧠 Why It Makes Strategic Sense:

By redirecting a portion of your retirement funds into a Golden Visa-eligible investment fund, you can:

- ✅ Diversify your investment internationally and protect against U.S.-centric and US dollar risks

- ✅ Gain a foothold in the EU without selling assets or using personal savings

- ✅ Keep the tax-advantaged status of your retirement account

- ✅ Open a path to EU residency or citizenship—without moving right away

And as global mobility becomes more restricted, Portugal’s Golden Visa stands out as one of the last remaining stable, transparent programs in Europe. (Spain, for example, just suspended theirs.)

At The Golden Portugal, we specialize in helping Americans understand how to legally and efficiently use retirement accounts to access this opportunity—no travel required.

🧠 What Is a Self-Directed IRA or Solo 401(k)?

These are special types of retirement accounts that give you control over your investment choices—beyond just mutual funds or stocks.

Both allow you to invest in real estate, private equity, startups, and in this case—a Portugal Golden Visa investment fund.

Why Consider This Pathway?

For many U.S. investors, the Portuguese Golden Visa offers one of the most flexible investment migration paths globally. The ability to use retirement funds makes it even more appealing, allowing you to:

- Diversify Wealth Globally: Spread your investments beyond U.S. borders and US dollars.

- Secure Alternative Residency: Gain a foothold in the European Union.

- Leverage Tax-Deferred Savings: Potentially grow your investment in a tax-advantaged way.

🌍 Why Choose a Portugal Golden Visa Fund?

Portugal’s Golden Visa program allows non-EU citizens to gain residency rights through investment, with eligibility for citizenship after 5 years—without needing to live in Portugal full-time.

Key fund advantages:

- ✅ Professionally managed with solid returns

- ✅ Minimum holding period: 5 years

- ✅ Transparent legal structure (usually through a Portuguese Venture Capital or Private Equity fund)

Speak with an Immigration Specialist

How to Use Your 401(k) or IRA: A Step-by-Step Guide

Investing in a Portuguese Golden Visa fund with your retirement account involves a few key steps:

Evaluate Your Account’s Eligibility:

- Confirm if your current IRA or 401(k) (especially from a previous employer) is eligible for a rollover into a Self-Directed IRA (SDIRA). Most traditional IRAs and many 401(k)s qualify.

Choose an SDIRA Custodian:

- Select a custodian experienced in international investments, specifically Portuguese Golden Visa programs. Some custodians are prepared to facilitate direct investments into eligible funds without requiring you to set up an LLC in the U.S. or Portugal. The Golden Portugal can offer recommendations for vetted custodians based on your needs.

Set Up Your SDIRA or Solo 401(k):

- Open your SDIRA account and fund it through a rollover from your existing retirement account. Ensure the custodian explicitly allows for direct investment into international funds that are eligible for Portugal Golden Visa.

Select a Golden Visa-Eligible Fund:

- Choose a regulated Portuguese fund that qualifies for the Golden Visa. These funds often focus on various sectors, such as private equity or venture capital, and are structured to meet the program’s requirements. The Golden Portugal team can assist you in screening suitable fund options.

Make the Investment:

- Your chosen SDIRA custodian will typically wire the funds directly to the Portuguese investment fund. In many cases, this can be done without needing to open a personal bank account in Portugal for the investment itself.

Submit Your Golden Visa Application:

Once the investment is made and documented, you (often with the assistance of a legal team specializing in Golden Visa applications) will prepare and submit your application to the Portuguese authorities.

Maintain Compliance and Renew:

- Fulfill the minimum stay requirements in Portugal (currently an average of 7 days per year).

- Ensure your SDIRA remains compliant with all U.S. tax rules and regulations.

Key Benefits for U.S. Investors:

- Tax Efficiency: Leverage tax-deferred or tax-free growth potential of your retirement savings.

- Investment Control: Maintain control over your investment choices through a compliant SDIRA or Solo 401(k).

- Regulated Investments: Invest in vetted European funds.

- EU Access: Get the Portuguese residency and enjoy visa-free travel within the Schengen Area and a potential path to EU citizenship after approximately 5 years (subject to meeting all requirements).

Important Considerations & Potential Complexities:

While this pathway offers significant advantages, it’s crucial to be aware of potential complexities:

- IRS Rules & “Prohibited Transactions”:

- Any violation of IRS rules regarding “prohibited transactions” by the investor can result in the disqualification of the IRA and full taxation of the invested amount.

- It’s essential to ensure the investment structure does not provide a “current personal benefit” that could be scrutinized by the IRS. Please consult your tax advisor in the US on this matter.

- Investment Structures:

- Direct SDIRA Investment: As outlined in the steps above, many custodians now facilitate direct investment from an SDIRA into a Portuguese fund.

- SDIRA with an LLC: Historically, and in some specific circumstances, a structure involving a Self-Directed IRA forming an LLC (where the IRA is the sole shareholder and the investor is the manager of the LLC) has been used. This LLC then makes the investment. This structure requires careful setup to ensure compliance and that beneficial ownership is correctly attributed for Golden Visa purposes.

- Due Diligence & Professional Advice:

- Fund Compliance: Ensure the chosen fund and its management team accept investments via SDIRA structures and understand the procedures for Golden Visa applicants.

- Legal & Tax Counsel: It is strongly advisable to obtain a qualified legal opinion from a U.S. tax lawyer/law firm. They can provide clarity on potential U.S. taxation impacts, including any tax consequences of investing via this structure.

- Transparency:

- Absolute transparency regarding the beneficial owner is critical for the fund’s KYC (Know Your Customer) and AML (Anti-Money Laundering) processes. All documents proving the IRA holder’s control of the investment must be obtained and filed.

A Real-Life True Client Account: How Kate & Bill Used an SDIRA to Fund Their Portugal Golden Visa

P.S. The Golden Portugal team is deeply grateful to Kate and Bill for generously sharing their journey in such detail. Their experience offers invaluable insights for future clients considering the same route. Below is their real, unedited account—with only minor personal details masked or altered for privacy.

Meet Kate and Bill, an American couple seeking long-term residency options in Europe as a “Plan B.”

Here’s how they did it, what they learned, and what they wish they knew earlier:

Regarding IRA financial (a self direct IRA provider):

Doing the initial setup was easy with them. Just fill out the paperwork and pay the fee.

It took a few weeks to transfer in our traditional IRA and 401k into IRA Financial.

I had already liquidated the IRA assets a few months earlier, so this was just moving cash. This is important, because liquidating investments can add extra time. And it went really quick because IRA Financial was able to do the standard process where they reach out to the original custodian for you and receive the money in a wire.

The 401K took longer because I requested the transfer from the vanguard side, and had them issue a check. This took a long time in the mail.

I love that you can consolidate both 401K assets and IRA assets into the SD-IRA.

We did the LLC option, which costs an extra one time fee of $1K. The annual charge for their service is about $500, which is fairly low when I compared services.

Fund A said that the LLC was unnecessary since IRA financial can wire the money with all the right details. However, we were unsure about this path since the bank account wouldn’t have Kate’s name on it (IRA financial’s would), so we weren’t sure it would work for Fund B. I am glad we did the LLC in the end. But there are a few extra things to know in this path

IRA financial doesn’t tell you how to fill out the paperwork. But I read online that it is critical that the LLC have Kate as the one and only officer of the company. So we did it that way.

Setting up a checking account for the LLC can take extra work, especially if you do it yourself. IRA financial has an option to do a quick bank account setup for you that is managed by them. This ended up being a good choice for us and probably saved another week.

The LLC bank account added an extra week of time because the money had to be moved from IRA financial’s custodian account over to the new checking account.

When you go to wire the money with IRA financial, they send you forms which are not obvious how to fill them out. I was planning to give your team copies of how we filled the IRA financial form for Fund A and Fund B so your next client doesn’t have a problem (👉 Thanks in Advance, We will add those annotated forms to our internal toolkit—so future clients can skip the guesswork and get it right the first time.!). Going back and forth with IRA financial on this took a whole week.

You get passed around at IRA financial quite a lot….I think we worked with 8 different people, one for each little piece. We did get a little stuck once, but after reaching out to a manager we were expedited through the rest. If you read the reviews, you can see this has happened to some folks before. If you expect a small amount of trouble going in…not a perfectly smooth process, then I think the value provided by IRA financial and the low fees make it totally worth the small trouble, overall.

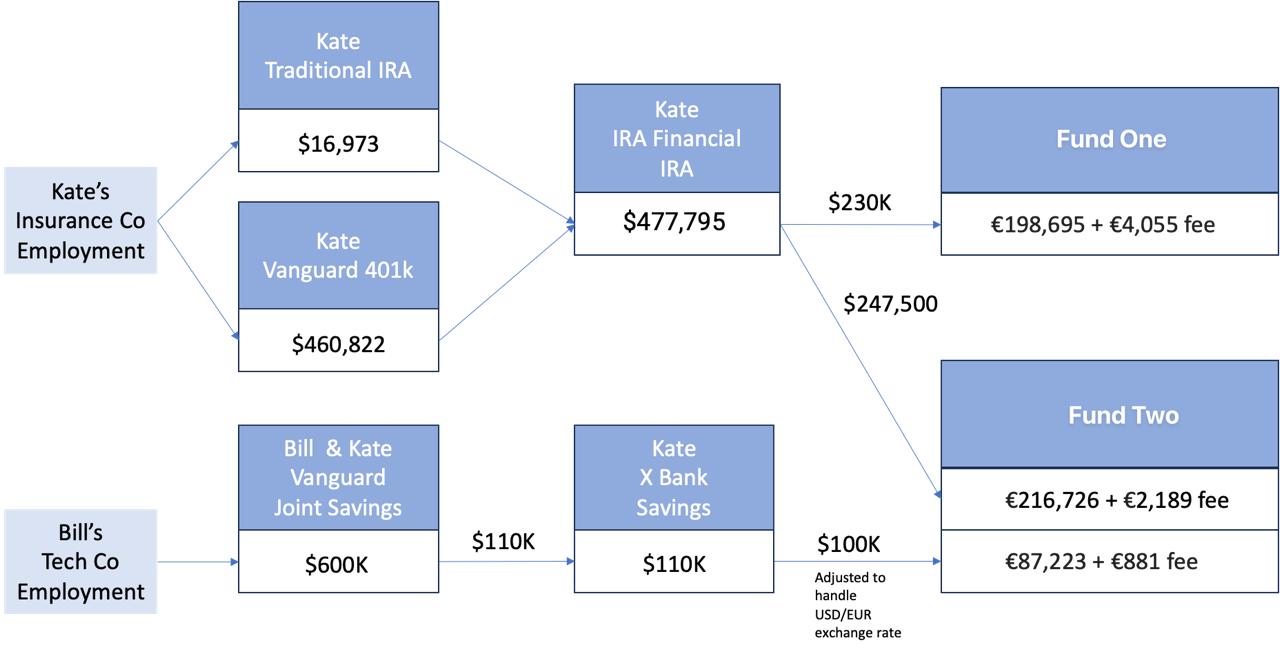

The is the structure of their investment:

Regarding the overall process:

We couldn’t use my IRA/401K because I am still working. So the assets are tied up with my employer. This caused us to shift our entire application into Kate’s name and changed all the primary documents. This choice needs to be made VERY EARLY in the process. You can’t change this part easily.

You also can’t easily add money to either your 401K nor your IRA. There are annual caps to the IRA ($8K). And to use your 401K you probably can’t be working anymore. That’s why we had to use an additional bank account to make up the money.

Fund A was explicit in their presentation that they would accept both IRA and non-IRA investments and issue investment certificates for both. I didn’t confirm this with Fund B (nor confirm the opposite). But this is why we did the extra investment with Fund A and not Fund B.

We decided to split our investment to 200K with Fund B and 300K to Fund A after consulting with our financial advisor and discussing our personal preferences and risk tolerances. This choice was entirely financial and actually made it more difficult to do the setup. We could have simplified by selecting a single fund, or by wiring the IRA to one fund and our make-up money to the other. “We didn’t do this because the investment lasts for years, but the setup effort is one-time. I’m glad we chose to put in the extra effort now to have the investment mix we preferred”.

When I did documentation for the funds, I had to prove every one of the boxes below. So for Fund B they wanted proof of retirement and statements all the way to the wires. And Fund A wanted my employment proof as well, along with the vanguard joint account.

We had to do the extra hop through a solo owned bank account (not a joint account) for Fund A to do the right paperwork. The good news is that they allowed the funds to originate from our joint account which was funded by my job. They simply had to pass through the bank account.

We did have an extra day dealing with the bank wire because of their fraud team stopping the original wire.

My advice: “expect a few hiccups. And the more accounts and moving pieces you have, the more bumps along the way. But they are typically only a day or two, and it works out in the end”.

Lessons for Other Americans Considering This Path

1. Plan Ownership Early

If only one spouse has accessible retirement accounts, structure everything in their name from the start—changing names later is complex.

2. Document Everything

Each fund has its own source-of-funds documentation requirements.

Be ready to provide statements, proof of employment, wire confirmations, and sometimes intermediate account activity.

🧭 Takeaway: A Few Hiccups, a Lifetime of Options

Kate and Bill’s story reminds us: yes, the beginning may have a few bumps—forms, wires, back-and-forths—but those are short-term hurdles for a long-term win. In just a few weeks, they set up a future-proof investment, secured their Plan B, and unlocked a pathway to EU residency and citizenship. If you’re waiting for a “perfect” time—this is your sign. Start now, navigate a few steps with us, and gain a lifetime of global freedom.

Overall? Worth it!

Ready to Explore This Pathway?

Investing your retirement funds in a Portuguese Golden Visa can be a transformative step toward financial security and global mobility. Portugal’s stable political environment and the strong reputation of its Golden Visa program make this an ideal time to act.

Here’s how The Golden Portugal can support you:

- Vetted SDIRA Custodians: We can connect you with experienced custodians who understand these investment structures.

- Golden Visa-Eligible Funds: We’ll help you find the right funds that accept SDIRA investments.

Contact us today, and let us help you plan your future in Portugal!

Disclaimer

The Golden Portugal is not affiliated with any of the third-party institutions, financial service providers, mentioned in this case study. All references are included solely for educational purposes to illustrate a real client’s personal experience. This is not financial, legal, or investment advice, nor an endorsement of any specific service provider.