“Where should I start? What are the steps and procedures to apply for the Portugal Golden Visa?” That’s usually how every Golden Visa journey begins — with questions and curiosity. Over the years, we’ve helped many clients turn those questions into confidence.

In this guide, we’ll walk you through the Portugal Golden Visa application process, including the key steps, requirements, and tips on how to apply for the Portugal Golden Visa successfully. Here’s the clear, structured path we follow to make your journey smooth, transparent, and stress-free.

Five Key Portugal Golden Visa Application Steps

Step 1 – NIF (National Identification Number)

TTo apply for a Portugal Golden Visa, the first thing you need is an NIF, as it’s essential for almost everything you do in Portugal. Getting a NIF doesn’t mean you are liable for paying tax in Portugal. If you are not a tax resident (i.e., not living in Portugal for more than 183 days per year), you don’t need to pay taxes in Portugal for income obtained outside of Portugal. You can get your NIF months, even years, before you actually submit your visa application. It is recommended to get this as soon as possible.

All main applicants will need an NIF. And we encourage all other adult applicants to get an NIF as well, as it strengthens the ties with Portugal when it comes to applying for citizenship. We can apply for the NIF on your behalf remotely, and our company will serve as your tax representative.

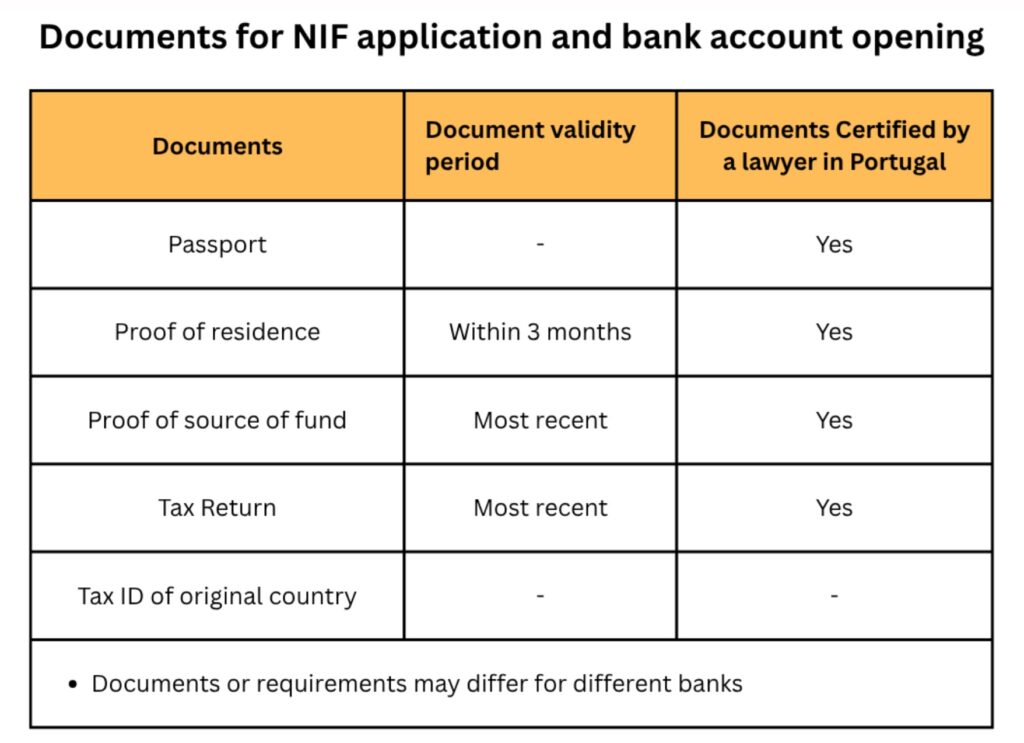

- Personal documents needed: passport and address proof

- Other documents: declaration forms for appointing your NIF representative, NIF application submission form – We will prepare these documents for you to sign.

Note: Documents need to be certified by your lawyer in Portugal. (We include this with our service.)

Step 2 – Open a Bank Account

Only the main investor is required to open a bank account in Portugal as part of the Portugal Golden Visa application process. We will introduce you to a trusted bank for account opening.

Please note that banks have their own regulations and processes. Some banks don’t accept clients from certain nationalities or specific investment routes, and not all banks can open accounts remotely. We will connect you with a bank (and the dedicated account manager) that can work with you based on your nationality and chosen investment route.

Personal documents required — depending on the bank, but typically include:

- Passport

- Address proof

- Most recent tax return

- Tax ID of currently residing country

- Bank statement(s) with €500,000

- Source of funds below:

- Some banks don’t work with D visa clients

- Some banks don’t accept American that invest in funds

- Some banks require €30000 deposit for D visa clients

Note: All documents, including bank account opening forms and personal documents, must be certified by your lawyer in Portugal. (This certification is included in our service.) opening forms and personal documents, must be certified by your lawyer in Portugal. (This certification is included in our service.)

Step 3 – Bank transfer and investment fund subscription

During the Portugal Golden Visa application process, applicants are usually most concerned with the investment options. We can provide you an overview of the investment funds and walk you through the most important aspects of each fund. We can also arrange calls with fund managers.

Personal documents needed are very similar to the bank. Please note that each fund may have their own procedures, but normally, below are the documents needed.

- Fund subscription forms

- Passport

- Address proof

- Most recent tax return

- Bank statement(s) with €500,000

- Source of funds

- From employment – employment letter, pay slip

- From investment – investment statement

- From sales of assets – sales agreement and related documents

We will introduce you to the fund manager, assist you on the fund subscription, send the needed documents to the fund(s) and certify documents when needed.e fund manager, assist you on the fund subscription, send the needed documents to the fund(s) and certify documents when needed.

Step 4 – Personal documents

At the same time, you should start preparing personal documentation for the online Portugal Golden Visa application, like

- Police report (anyone over the age of 16)

- Marriage certificate (for spouse)

- Birth certificate (for kids) (for parents)

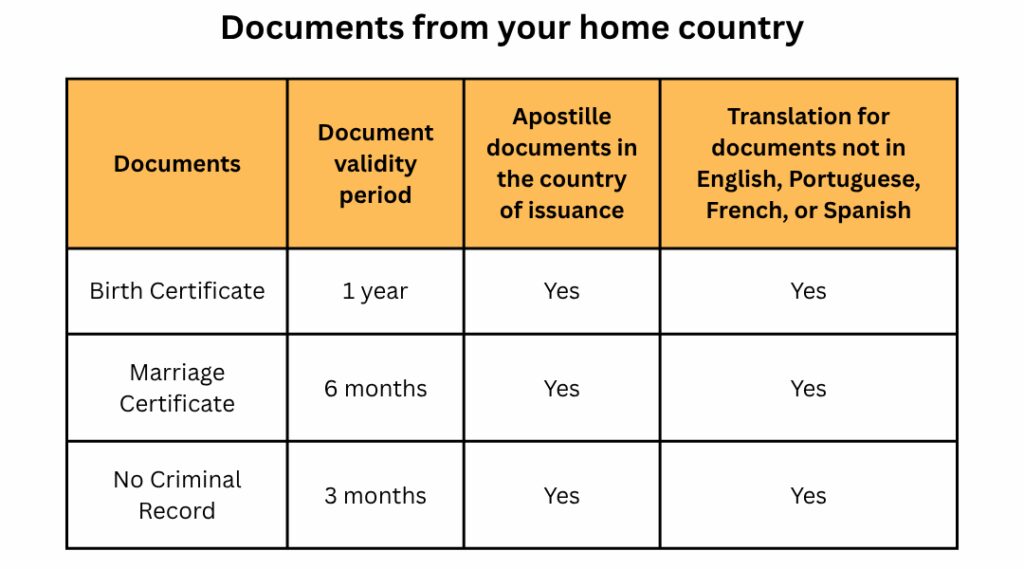

Please note that all these documents need to be apostilled.

The critical one is the criminal record. Countries differ in how they issue the criminal record for their residents. Some countries even require a request letter from the Portugal Consulate in order to process the issuance of the criminal record. Getting the police report and getting it apostilled alone may take 2 months.

However, getting the documents is not always the sooner the better. For example, the police report only has a 3-month validity period (from the issuance date to the online submission date). We will guide you to get these documents at the right timing.

Note: If your country is not a member of the Hague Convention, you will need to have your documents certified at the nearest Portuguese consulate or embassy.

Refer to the table below for the validity period of the documents and the apostille requirements.

Note: The above is not the full list of documents, as other documents may be needed for your dependents (e.g. proof of student status, single, and dependent, retirement status and so on).

Other than documents from your original country, you would also need to get documents in Portugal, such as the below

- Applicant’s permission for the authorities to access his/her Portuguese criminal record.

- Certificate of no debts from the Portuguese tax and national insurance offices.

- Signed statement by the applicant that he/she will fulfill the investment requirements.

- Evidence that the minimum investment has been made (declaration letter from fund manager(s))

- Declaration letter from your Portugal bank confirming the transfer of the required funds

We will assist in requesting the above-mentioned information during the Portugal Golden Visa application process.

Step 5 – Online submission

We will complete the necessary forms and submit your Portugal Golden Visa application online through the AIMA portal.

Our role as your consultant is to guide you throughout the entire Portugal Golden Visa process. We act as the main coordinator between you, the bank, the fund manager, and the lawyer, ensuring everything runs smoothly.

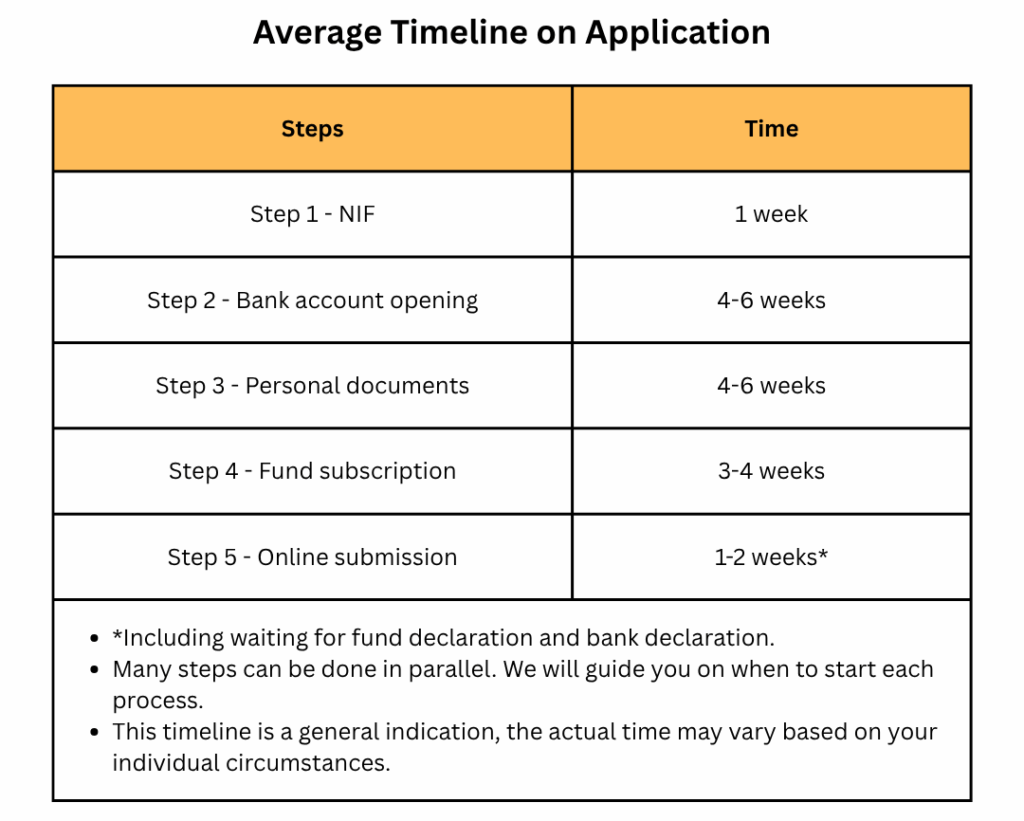

How Long Does the Portugal Golden Visa Application process Take?

The Portugal Golden Visa application processing time, from start to finish, typically takes about 3 to 4 months. We can also help speed up the process for clients if needed. The fastest application we’ve submitted was completed in just 1.5 months!

Let’s take a look at the timeline for the Portugal Golden Visa application steps below:

Factors affecting application progress:

If you live in a place where the Portuguese bank has a representative office, you can speed up your bank account opening process.

- If your country is not in the Hague Convention, it may delay your process as you would need to get your documents certified in the nearest Portuguese embassy/consulate.

Banks and funds have a KYC (Know Your Client) process to verify your source of funds, and they can ask for more supporting documents, which may delay your process.

How Can The Golden Portugal Help Speed Up Your Portugal Golden Visa Process?

When you need an experienced partner to guide you through every phase of the Portugal Golden Visa application process, we’re here for you.

Our company, The Golden Portugal, specializes in the Portugal Golden Visa program, offering a complete one-stop solution from start to finish. Here’s how we help:

- NIF application and acting as your NIF representative

- Introducing the right bank for opening a bank account in Portugal

- Sourcing and introducing suitable investment options

- Providing detailed analysis of projects so you can make informed decisions

Our strength lies in finding the right investment opportunities tailored to your needs and ensuring compliance every step of the way.

In addition, we guide you through critical steps such as:

- Where and how to obtain your police report

- How to certify or apostille your documents

- Document certification for banks and fund KYC processes

- Maintaining strong connections with banks and fund managers

- Helping resolve any issues during your Golden Visa journey

Learn more about the Portuguese Golden Visa and how we can help get your Portugal residency and citizenship!

Contact us today to begin your Portuguese journey with expert guidance every step of the way.