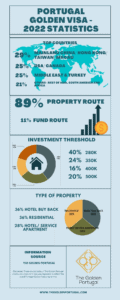

A Paradigm Shift in Portugal Golden Visa Investments – The Portugal Golden Visa program underwent a pivotal shift with the cessation of real estate investment options on October 7, 2023. Investment in funds has emerged as the new front-runner, revolutionizing the approach to obtaining the Portugal Golden Visa.

Since its inclusion in 2017, fund investments have increasingly become a popular choice for Golden Visa applicants. This relatively new avenue, in comparison to the property investment route that was launched in 2012, offers a more diverse range of investment opportunities.

The regulatory changes effective from October 7th, 2023, introduced certain restrictions on fund investments as well. Namely, funds involved in real estate, previously a mainstay, are no longer eligible. However, investors can now explore an array of industries like renewable energy, agriculture, AI, biotech, tourism, winery, financial markets like bonds, stocks & commodity, and even niche areas like football. The introduction of such diversity of funds gives client much more choices in selecting different assets into their investment portfolio.

Here is the list of some of the most popular Portugal Golden Visa fund options.

8 Advantages of Fund Investments for Portugal Golden Visa

Low transactional cost

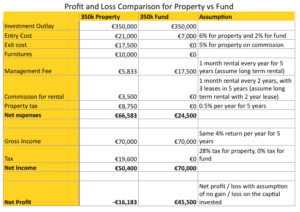

The entry cost of a typical fund is anywhere from 0% to 2.5%. And normally, there is no exit cost at the end of the fund exit. The lower transactional cost means that more of your money spent will be on your investments and not on fees.

Low maintenance cost

The typical management fee of a fund range from 1%-2%, which are mostly covered from the fund, there is no need for investors to pay on top. Meaning other than the initial cash outlay at the beginning, you will not have any other out-of-pocket expenses throughout the lifespan of the fund.

Profits from funds are tax exempted

Profits from the funds are tax exempted, meaning the fund will be more efficient in retaining the profit and cultivate greater capital growth for its investors. This is substantial, as the corporate tax in Portugal is around 21%.

Income and capital gains from funds are tax exempted

On top of the above, income and capital gains investors get from the fund are also are tax exempted. This means investors get 100% of any income and capital gains, plus their initial capital, without having to pay a cent of tax.

Diversification on investment

The fund will diversify their investments into different companies and/ or assets, mitigating risks. On top of that, you can split the €500,000 to invest into several funds, in invest in different industries, further diversifying your risk and income stream.

Higher potential earnings

Depending on the fund policy and targeted risk/return, capital gains yield can be significantly higher comparing to other investment options related to the Golden Visa program. We have funds from the more conservative end (with guaranteed buy back) has a guaranteed return of 2% per year; to the more aggressive end with anticipated return of 25% per year; and everything in between.

Funds are highly regulated

Funds eligible for the Golden Visa are regulated by the Portuguese Securities Market Commission (CMVM), ensuring compliance, transparency, and investor protection. You can find a list of CMVM funds in its website.

Expert asset management

Professional fund managers oversee these investments, offering a level of sophistication and insight typically unavailable to individual investors. Also, fund manager’s objectives are aligned with investor’s as most funds have a performance fee which gives fund managers an extra motivation to achieve great results

Here is the list of some of the most popular Portugal Golden Visa funds.

The Golden Portugal has long advocated for fund investments within the Golden Visa program, even before the termination of the real estate investment route. We believe that fund investments offer lower costs, tax exemptions, diversity, and professional management, making them a preferable choice for investors. Since pioneering fund options for Golden Visa clients in 2020, we already have 400+ clients opting for this route, illustrating a growing confidence in this investment strategy, and our strengths in this area.

How to Choose The Right Funds for Your Portugal Golden Visa Application

Choosing suitable funds for the Portugal Golden Visa requires a multi-faceted approach, considering one’s risk tolerance, return objectives, and investment timeline.

Risk Profile Assessment

To start with, you should ask yourself how much risk you are willing to take. Are you risk-adverse or risk-taking?

Other than looking at the asset class / industry of the fund, another way to lower your risk is to diversify your allocation of investment. The more diversified, the lower the risks, as your investment is not concentrated in one asset type or in one industry. This strategy is particularly advantageous in a volatile global economy, providing stability and potential for growth.

Note that the 500k required investment for Portugal Golden Visa can be split to be invested in different funds.

Also, when you look at the risk of the fund, you should also consider if the fund uses leverage. The higher the leverage, the more risk the fund is taking, especially in an economic downturn. Taking on leverage means, borrowing money, the more leverage they use the more pressure they will have to generate income or sell the asset to pay off loans.

Return Objectives

It’s essential to align expectations with realistic return potentials. High returns often come with increased risk, so balancing these factors is key to a successful investment strategy.

Then, you should look at the return potential of the asset class where the fund invests.

A general rule of thumb is that the higher the return, the higher the risk. The lower the risk, the lower the return. So a realistic combinations of risk and returns should be set. A low risk fund with a ultra high return is unrealistic and maybe too good to be true.

We covers funds of a wide spectrum – from the most conservative (that gives out a return of 2% per year with capital preservation) to the most agresive (pre-seed venture capital fund that has an anticipated return of 25% per year), to everything in between.

Investment Timeline

Understanding the lifecycle of funds, typically spanning 8-12 years, is vital. This includes the initial fundraising period, the active investment phase, and the exit strategy aiming for profit realization.

All of the private equity funds we are talking about are closed end fund. Meaning they have a pre-determined fund life span. Most of these funds have a lifecycle of 8 – 10 years. Normally, the first 2-3 years of the fund are subscription/ fund-raising period, where the it fundraises money for investments. The next phase is the investment period where the fund will deployed the money raised to buy assets and the last phase is the exit phase, where they will liquidate and sell the fund assets. The ultimate object is to sell the portfolio’s assets at a profit. (Note: All of this will be deployed as per the fund regulations). Fund that are closed (after their fund-raising period), or funds that have achieved their fund-raising target, will no longer accept new subscription.

In conclusion, investors should carefully evaluate their objectives, risk profile, and total asset allocations (both within the scope of your Golden Visa investment and also your total investment portfolio), to choose the most suitable fund for their Portugal Golden Visa application. With a wide range of options available, it’s crucial to make an informed decision that aligns with your financial goals and preferences.

Here is a complete guide on Portugal Golden Visa. Please visit the relevant pages for expert guidance and insights.